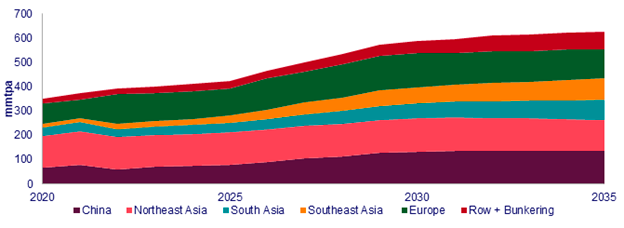

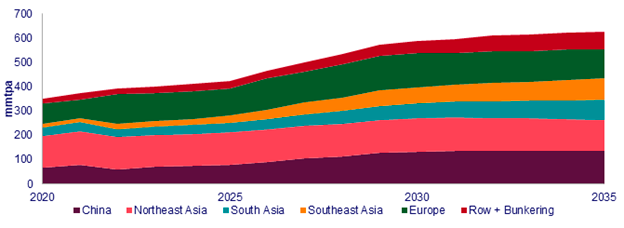

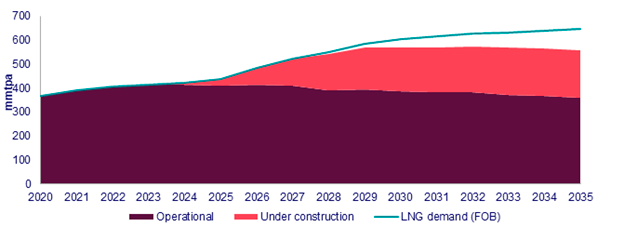

Global LNG market needs 90 mmtpa of additional supply by 2035 to meet booming demand

Volatility now a market constant Massimo Di Odoardo tells delegates at Wood Mackenzie Conference

LONDON 14th November 2023 –The global liquefied natural gas (LNG) sector will need 90 million tonnes per annum (mmtpa) of new supply by 2035 to sate growing demand with market volatility expected to persist as the market rebalances post 2025 according to Massimo Di Odoardo, Vice President, Gas & LNG Research at Wood Mackenzie.

Speaking at Wood Mackenzie’s Gas, LNG and the Future of Energy 2023 conference taking place in London, Di Odoardo told delegates that there is no end in sight to the current volatile market dynamics currently in place.

“There is no immediate cure as most supply under construction will not be available until at least 2026,” Di Odoardo said. “As a result, buyers still face some years of high – and volatile – prices before the next wave of LNG supply rebalances the market and improves affordability.”

Di Odoardo added that recent market dynamics are a stark reminder of how susceptible energy markets are to external shocks, including conflict, geopolitical tensions and supply disruption.

“The global gas market has staged a remarkable recovery since Russia’s invasion of Ukraine in early 2022 but remains easily spooked,” Di Odoardo said. “The conflict in Israel/Gaza, possible pipeline sabotage in the Baltics and the threat of strike action at Australian LNG facilities all pushed spot prices up 35% through October.”

Global Gas Demand

Source: Wood Mackenzie Global Gas Service

Market volatility “a constant”

Di Odoardo added that a record 200 mmtpa of new supply is under construction as players bet big on Asia’s push to reduce its dependence on coal and Europe’s need to replace Russian gas. However, he added that with Europe increasingly dependent on LNG, and with limited flexibility from pipeline imports and coal, Europe and Asia will both rely on global LNG availability. This will expose the market to continued price volatility.

“At times of excess LNG supply, prices could be extremely low as the market tries to absorb more LNG than required, possibly testing the economics of US LNG,” Di Odoardo said. “But as markets tighten, for examples during cold winters across the Northern Hemisphere, prices could be extremely high as both Europe and Asia scramble to secure marginal cargoes meaning volatility will persist also after the market has rebalanced in the second half of this decade.”

LNG suppliers confident about European demand

Di Odoardo also told delegates that despite declining European gas demand, the anticipated decline in domestic production and imports from Algeria as the decade progresses, LNG demand across the continent will not peak until 2030.

“The recent signing of 8 mmtpa of LNG contracts from Qatar and its partners Shell, TotalEnergies and Eni to Europe through 2053 underpins supplier confidence in the longevity of European LNG demand,” DI Odoardo said.

Global LNG Supply-Demand Gap

Asia, the traditional major market for LNG, will see demand for the resource increase with imports into China and several other emerging markets in the region rising two-fold by 2030 Di Odoardo said. He cited China as the key market and told delegates that LNG demand will increase by 12% in 2023, while longer term demand growth is underpinned by the 50 mmtpa of LNG contracted over the past two years. Other emerging markets in Asia will also need to grapple with declining domestic supply, boosting LNG import requirements. However, he added that while increased economic growth in Asia will be the major driver of LNG demand, that will not be enough.

“Domestic policies across Asia must increase their focus on decarbonisation and ensure appropriate pricing and infrastructure developments,” Di Odoardo said. “LNG developers must also play their part, ensuring affordable LNG supply if Asia’s full potential is to be unlocked.”

Editor’s Notes

• Wood Mackenzie’s Gas, LNG and the Future of Energy Conference has brought together some of the biggest names in the industry and is taking place on the 14-15 November in London. For more information please click here.